13 dollars an hour 40 hours a week after taxes

35 an hour 40 hours a week is 1440 every 2 weeks before taxes. Weekly salary 60000.

18 Dollars An Hour Is How Much A Year Budget Taxes Jobs More Finance Over Fifty

This averages out to around 1324 bi-weekly after taxes.

. Note that if you take two weeks of unpaid leave per year your number of weeks will be 50 rather than 52. To figure out your net income for less than 40 hours a week we can calculate what 18 is per hour after taxes and then multiply by the number of hours you work. Comparison Table Of 13 An Hour.

Enter your hourly wage - the amount of money you are paid each. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 2400 after taxes. How much is 30 dollars an hour per month.

15 per hour X 40 hours per week X 52 weeks in a year is 31200 and 16 per hour X 20 hours per week X 52 weeks in a years is 16640 for a total of 47840. We start by dividing the 40-hour net income by 52 weeks. To calculate how much you will get paid per year lets assume you work 52 weeks of the year with 2 weeks paid time off.

Is 13 an hour good pay. If you are working a full-time job you will be working 40 hours per week on average. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

His income will be. Now you only need to multiply 2080 hours for 13 an hour and you get 27040 a year. For example if you did 10 extra hours each month at time-and-a-half you would enter 10.

If I have health insurance and other benefits withheld I always figure I will take home about 6065 If I just have basic deductions I figure I will take home about 70. His income will be. If you work 25 hours a week earning 18 an hour youll take home.

61236 40 hours 1531hour. 13 per hour multiplied by 2080 working hours per year is an annual. To enter your time card times for a payroll related calculation use this time card calculator.

40 hours multiplied by 52 weeks is 2080 working hours in a year. The more hours you work the more money you will end up making at this hourly rate. Overtime is the time worked after the limit of the 40 hours per week.

Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 2400 after taxes. Gross Pay or Salary. 10hour is in the bottom 10 of wages in the United States.

Answer 1 of 8. 10 Dollars An Hour 40 Hours A Week After Taxes. 18 dollars an hour at 25 hours a week part-time is 450 per week before taxes and about 394 after taxes.

3184254 net annual wages 52 weeks 61236week. People working overtime taking on extra work or receiving tips need to add them to the total number. More information about the calculations performed is available on the about page.

For example say you get paid every two weeks. Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary. Adding those extra work hours or tips can drastically.

7 rows 13 an hour multiplied by 40 hours per week is 520 per week income. Please note these numbers are exclusive of income tax. Example annual salary calculation.

An employee receives a hourly wage of 15 and he works 40 hours per week which will result in the following earnings. The problem is that everyone has different taxes to pay. In this case you would make a 40 hours x 52 weeks operation which gives you 2080 hours a year.

The following table shows what an hourly wage earner would make per week for 20 30 40 hour work weeks. If you work full-time every two weeks you would make 3200 before taxes. 18 an hour is how much bi-weekly.

This averages out to a bi-weekly salary of 1920 after taxes. To calculate how much you make biweekly before taxes you would multiply 40 by 40 hours and 2 weeks. If you work 40-hours a week at 30 an hour youll gross.

As an example if you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre-tax will be 15 40 52 31200. Hourly wage 2500 Daily wage 20000 Scenario 1. A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week.

This is your average gross income every week if you make 10 an hour weekly. If you work 25 hours a week at 30 an hour youll gross 1500 every 2 weeks and take home around 1270. 30 an hour 40 hours a week is 2440 every 2 weeks before taxes.

Making 40 dollars an hour is good pay. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions. If your are just looking for a ballpark estimate here is how I do it.

Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime. So on the top end you would take. If you work part-time 40 dollars an hour 20 hours a week you would earn 1600 before taxes.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

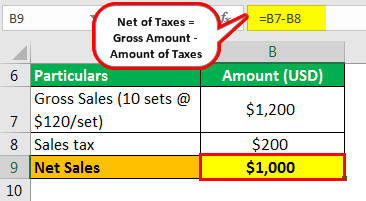

Net Of Taxes Meaning Formula Calculation With Example

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

12 Reasons Why Your Tax Refund Is Late Or Missing

Paycheck Taxes Federal State Local Withholding H R Block

Net Of Taxes Meaning Formula Calculation With Example

Limited Company Tax How What Where Why When

1 200 After Tax Us Breakdown July 2022 Incomeaftertax Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How To Do Your Taxes In 2022 Cbs News

35 000 After Tax 2022 Income Tax Uk

Here S The Average Irs Tax Refund Amount By State

2022 2023 Tax Brackets Rates For Each Income Level

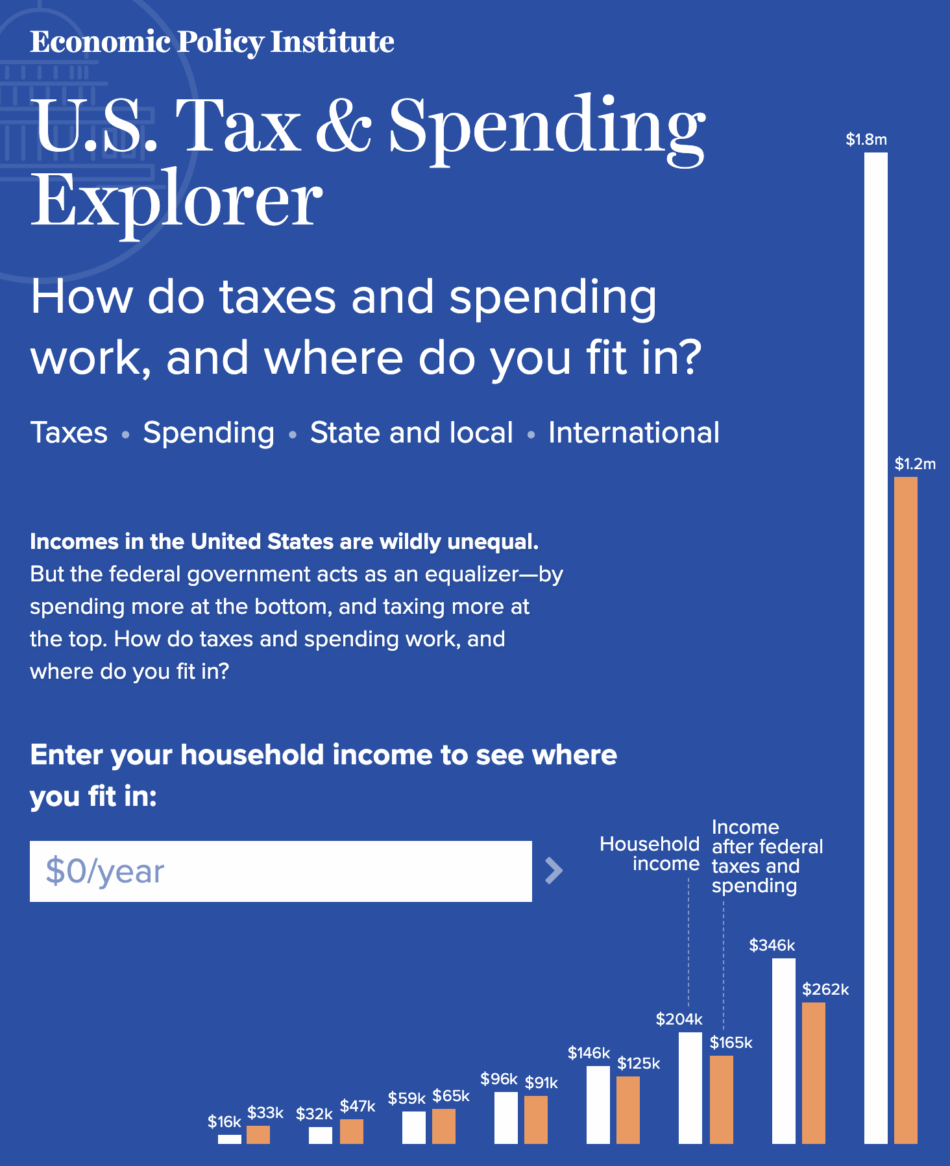

The U S Federal Tax And Spending System Is The Biggest Tool To Combat Inequality But It Could Do Much More Economic Policy Institute

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

Net And Gross Income 1 Budgeting Worksheets Budget Spreadsheet Template Financial Literacy Worksheets